Financial wellbeing…

(Definition) The sense of security and ease that comes with knowing you can pay your bills today, deal with the unexpected and that you’re on track for a healthy financial future.

Or, to paraphrase my clients: I want to stop stressing about money. I want to know I have enough money to live well – now and in future.

However you put it, we’re talking about the same thing: Financial wellbeing.

This is what I help my clients with.

Financial wellbeing matters because…

It’s hard to think clearly and make decisions that serve you when you’re living under a cloud of money worries.

Except… maybe you’re not there yet - there being financial wellbeing. And it’s not for a lack of trying.

Let me explain what I mean with a story. Representing my three main types of clients.

Are you sitting comfortably? Then I’ll begin…

-

As one client summed it up: My spending problem is my dirty secret.

You spend money on - as another client put it - stuff I don’t need and sometimes don’t even want.

Spending money is a quick fix to make yourself feel better, to comfort and soothe yourself, but the feeling is short-lived. You often feel guilty afterwards and regret the spending.

You thought you’d be more financially secure at this point in your life and it scares you that you’re not.

You’ve tried plenty to take control of your emotional spending. You’ve tried budgeting apps, unsubscribing from shopping emails, uninstalling shopping apps. But it’s not worked.

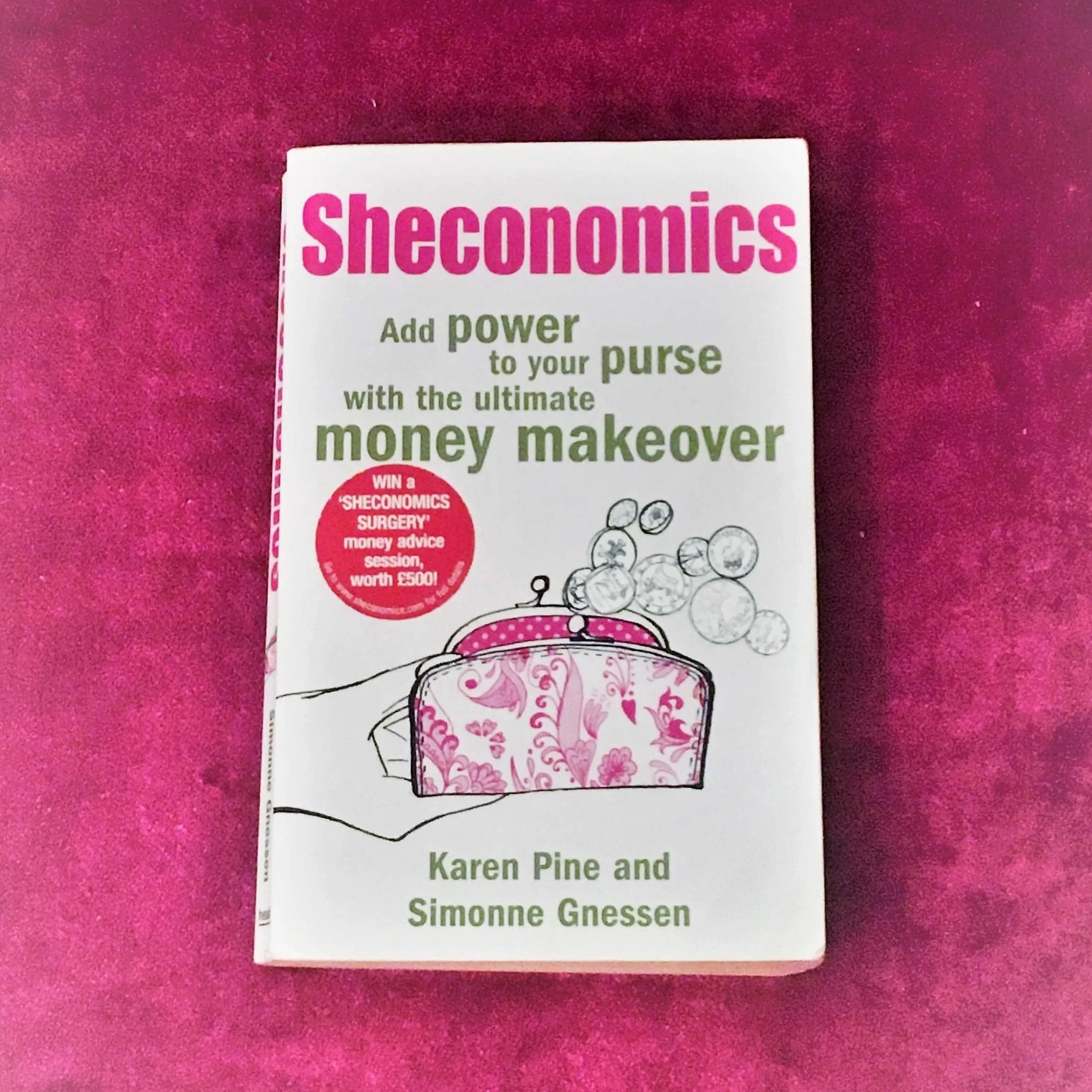

You’ve consumed books, blogs, podcasts, YouTube videos about money and found it easy to take in the information… but harder to take action.

And you’ve kept all of this to yourself. You’d like to confide in friends and family but…

1. You’re suffering from a bad case of comparison-itis that says everyone else is sorted, why aren’t I?

2. You fear being judged.

So you’ve said nothing. But you live with a constant level of stress because money is always nagging away at the back of your mind.

You’re now wondering if speaking to someone, a professional, might help.

Someone who can help you understand your behaviour with money so you can take control of your emotional spending.

If so, you’ve come to the right place. I’d love to help. 💛

Because where you are is not where you want to be. And while change is scary, stagnation is scarier.

You’re tired of:

-Not having enough money due to overspending;

-The stress and sleepless nights this causes;

-The embarrassment and shame you sometimes feel because your good income doesn’t match the reality of your financial situation.You want to:

-Be debt-free and have savings.

-Know and feel you have enough money to live well now, meet your future needs, and in case of emergency.

-Be free of financial stress, feel calm, sleep better, not feel scared, have peace of mind.

-Spend mindfully and enjoy every purchase without guilt, shame, or regret.There’s a name for all of this. Yep, you’ve guessed it – financial wellbeing. You’re seeking financial wellbeing. This is what I help my clients with.

COACH WITH ME -

I want to get a handle on my money but I don’t know where to start.

You live month to month, paycheque to paycheque and lack a bigger vision, long-term planning,

There’s so much information out there that you’re overwhelmed into inaction, as one client put it.

But you feel a restlessness because you’re not taking action. Where you are isn’t where you want to be.

You feel guilty when spending because you’re not really sure you can afford it. While you can make the monthly payment, you haven’t really considered what you’re saying no to long-term, to say yes to this spend today.

And because you’re not clear on what comes in and what goes out, you tend to live in your overdraft.

You tell yourself that you’re bad with money. But really, you simply haven’t figured out what good with money means to you.

You want to set goals, feel in control of your spending and see your savings increase.

You’re anxious about your long-term security and want to sort your pensions and start investing to future-proof your finances.

Freedom and security is your goal.

You want to have more knowledge and control over your finances so you can make informed money decisions without feeling overwhelmed.

Bit as it stands, you’ve kept all of your money worries this to yourself. Because you fear being judged.So you’ve said nothing. But you live with a constant level of stress because money is always nagging away at the back of your mind.

You’re now wondering if speaking to someone, a professional, might help.

Someone who can help you understand and take control of your behaviour with money.

If so, you’ve come to the right place. I’d love to help. 💛

Because where you are is not where you want to be. And while change is scary, stagnation is scarier.

-

As one client summed it up: I’m good with money - maybe too good with it.

Because while you spend less than you earn and you’re good with saving, when it comes to spending money on yourself, you convince yourself that you can’t afford it, that you don’t deserve it.

Whatever ‘it’ is - clothes, a holiday, your home - you tell yourself: Well, that money’s better off being saved. In case things go wrong.

Then there’s the struggle with making financial decisions. Rent or buy? Save or invest? You want to get it right but fear getting it wrong - so you do nothing.

You’re holding onto your money so tightly that it’s causing you stress and making you unhappy.

You’ve tried plenty to understand your money mindset - the emotions and beliefs driving your behaviour with money.

You’ve consumed books, blogs, podcasts, YouTube videos about money and learned lots… but you’ve struggled to apply what you’ve learned to your own life.

And you’ve kept all of this to yourself. Because you imagine that even loved ones will struggle to understand how being ‘good with money’ can be a problem. Understandably, you fear being judged.

So you’ve said nothing. But you live with a constant level of stress because money is always nagging away at the back of your mind.

You’re now wondering if speaking to someone, a professional, might help.

Someone who can help you understand and take control of your struggle to spend money on the things you need and want. Someone who can help you understand and take control of your financial indecision.

If so, you’ve come to the right place. I’d love to help. 💛

Because where you are is not where you want to be. And while change is scary, stagnation is scarier.

You’re tired of:

-Feeling like you have to hold on tightly to the money you’ve got and work relentlessly to earn more;

-Financial indecision;

-Feeling stuck and confused. You wish you could give yourself a break.You want to:

-Know and feel you have enough money to live well now, meet your future needs, and in case of emergency.

-Spend money on the things that matter to you and enjoy every purchase without guilt, shame or regret.

-Make financial decisions with confidence.

-Be free of financial stress and not feel scared about money.There’s a name for all of this. Yep, you’ve guessed it - financial wellbeing. You’re seeking financial wellbeing. This is what I help my clients with.

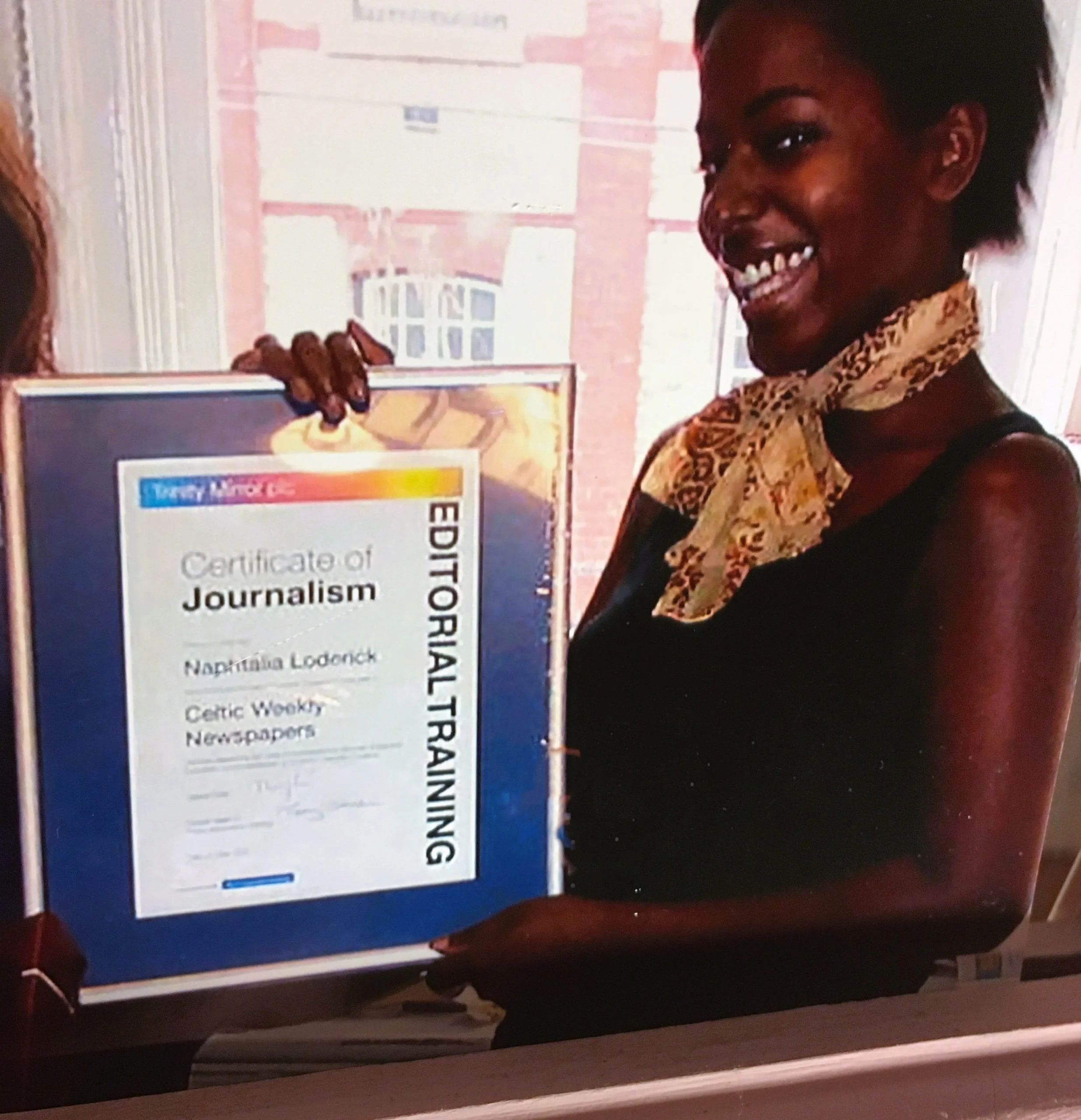

Hi, I’m Talia and I’m a Money Coach.

I help women understand and take control of their behaviour with money so they can stop stressing about money and start ensuring they have enough to live well – now and in future.

Talia Loderick Coaching is Money Coaching delivered with a big dose of TLC.

When I realised the acronym for Tender Loving Care also stands for Talia Loderick Coaching, I almost swooned with joy. Because who doesn’t need a dose of TLC from time to time? Rhetorical question - we all do. Especially when it comes to money. 💛

Talia Loderick Coaching is your judgement-free, safe space to…

Talk openly and honestly about your relationship with money, voice your fears and desires about money.

Make sense of your emotions and beliefs about money that drive your behaviour with money.

Take action. Figure out the behaviour you’d like to change, how you’d like to change it, and put it to the test. Keep what works for you, learn from what doesn’t.

One of my favourite quotes is “You can do anything but not everything.”

This quote reminds me that in a world full of options, temptations, and other people’s expectations, getting clear on what matters to me most helps me prioritise how I spend my time and my money.

As your money coach:

I help you get clear on where you want to go and support you on your journey to get there. As one of my clients said, when I asked why she wanted to coach with me: “It’s about having a clearer path to make things happen.”

I help you think big, get practical, make plans, set goals, solve problems and make decisions.

I’m your sounding-board, I provide support, I offer guidance and accountability.

Money Coaching designed to improve your financial wellbeing. Bliss. 💆🏾♀️

Talia Loderick, Money Coach for Women.

Why women?

Because no woman plans to have a poor old age. But:

The gender pensions gap stands at 35% (for every £100 of men’s private pension wealth, women have £65);

Across our working lives, women earn less than men;

And, on average, women live longer than men.

Gender financial inequality exists.

It’s important to shine a light on these hidden forces at work on women’s finances so we can raise awareness and make informed financial decisions on a personal and societal level.

More thought has to be given to futureproofing women’s finances.

Work with me

*My credentials! 👩🏾🎓

I gained my Coaching and Mentoring qualification from the Institute of Leadership and Management (2017).

I studied Introduction to Psychology at Cardiff Metropolitan University (2018).

I completed my Financial Coach Practitioner Certificate Training with Wise Monkey Financial Coaching (2018).

I attend Continuing Professional Development sessions for coaches, organised by NUJ Training Wales and run by The Professional Development Centre (2017-present).

I attend Continuing Professional Development sessions with - and I’m a member of - the Wise Monkey Financial Coaching Community (2020-present).

#AlwaysBeLearning 🧠