Money Coaching with TLC

How would you feel if you had your very own money coach?

50% personal trainer - but for your financial fitness instead of your physical fitness.💪🏾

+ 50% money confidante - someone for you to confide in who’ll listen without judgement and support you to take action.💆🏾♀️

= 100% someone you get to work with one-to-one, whose sole focus is to help you:

💛understand and take control of your behaviour with money;

💛stop stressing about money;

💛start ensuring you have enough to live well - now and in future.

Sounds dreamy, no?

This is what you get with me, Talia Loderick, Money Coach.

How TLC Money Coaching works

Our coaching sessions are always tailored to you - what you want to achieve from working together.

However, there is an overarching structure to how we’ll work together, with three main steps:

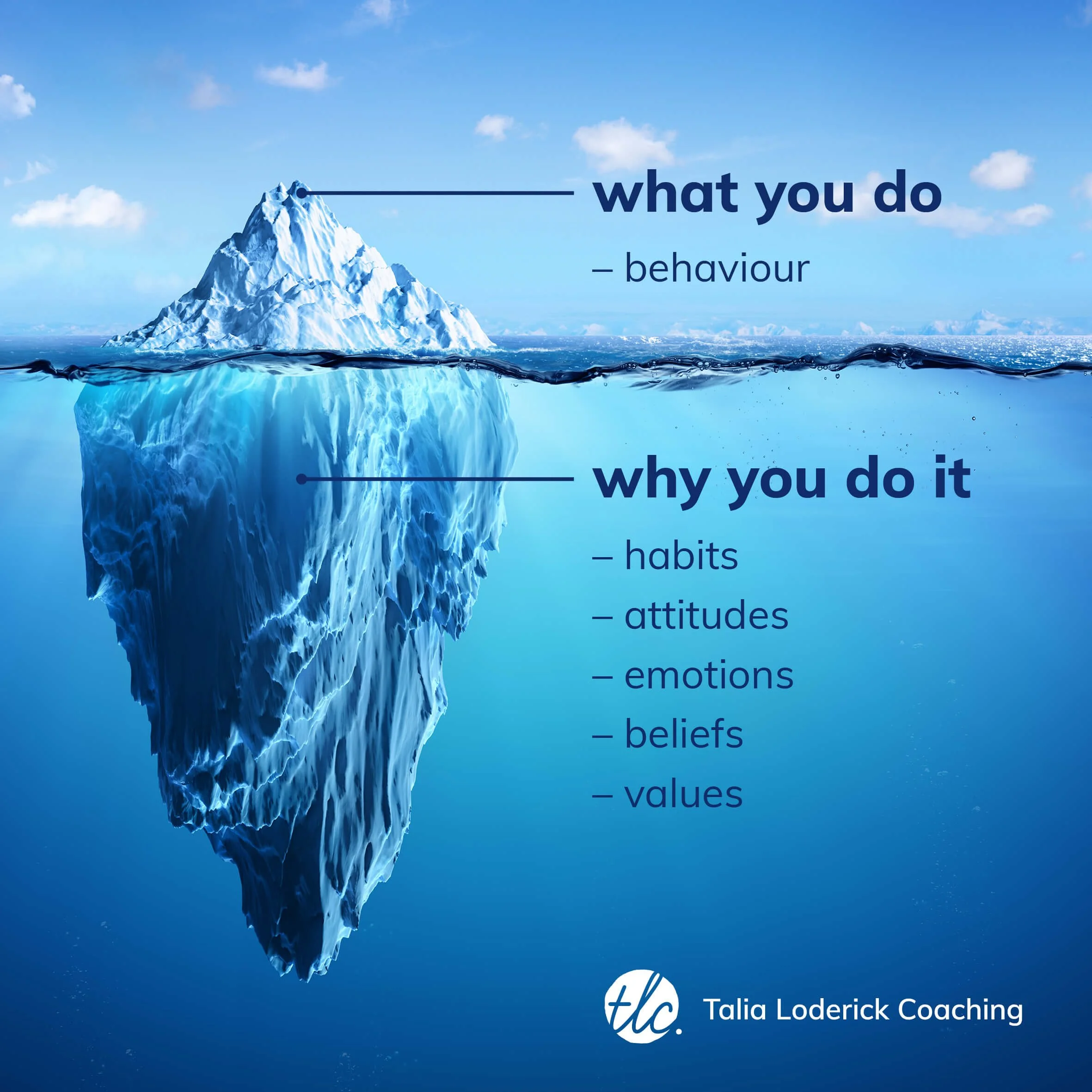

Our money coaching sessions are your judgement-free, safe space to talk through and make sense of your emotions and beliefs around money that drive your behaviour with money.

Our emotions such as fear, despair, guilt, shame, sadness and anger drive our behaviour with money.

Our beliefs such as I can’t be better with money because I wasn’t taught how growing up, or I don’t deserve to spend money on myself drive our behaviour with money.

And by ‘behaviour with money’, I mean the practical things we do - or struggle to do - with our money.

Behaviour like planning, budgeting, saving, investing, spending less, spending more, spending money on ourselves without feeling guilty, paying down debts.

Here we’ll:

get clear on where you are now and where you want to be;

complete a core values activity to pin down what really matters to you in life and consider how you spend, save, and invest your money in line with this;

explore your relationship with money. I’ll take you through Money Habitudes©, the leading money personality profile. You’ll learn how your habits, attitudes, emotions and beliefs influence your behaviour with money, with suggestions for behaviour-change.

Our money coaching sessions are your judgement-free, safe space to take action and build your financial knowledge.

You know the phrase do something different?

That’s what we’ll work on here to bridge the gap between where you are now and where you want to be.

Figure out the behaviour you’d like to change, how you’d like to change it, and put it to the test.

Keep what works for you and learn from what doesn’t.

Plus, this is your space to ask the questions you always wanted answers to but never asked because, well, embarrassment/shame/overwhelm etc.

As one client put it: I know there’s loads of information out there, blogs and websites, but it just feels really daunting so I don’t do anything.

From how to budget to when to invest to what can I do to boost my pension, consider me your money agony aunt.

Here, we’ll:

set financial goals and establish habits to help you achieve those goals;

create and implement spending and saving plans;

build your financial knowledge. I’ve put together a list of Financial Education 101 topics, from budgeting to investing to pensions and more. Choose one or more topics for us to discuss in our coaching sessions. 🎓

Our money coaching sessions are your judgement-free, safe space to think big, get practical, make plans, set goals, solve problems and make decisions.

RESULT:

💛Be free of financial stress

💛Ensure you have enough money to live well – now and in future

💛Feel calm, sleep better, have peace of mind

💛Spend money mindfully on the things that matter to you and enjoy every purchase without guilt, shame, or regret

💛Make financial decisions with confidence

As your money coach:

I help you get clear on where you want to go and support you on your journey to get there. As one of my clients said, when I asked why she wanted to coach with me: “It’s about having a clearer path to make things happen.”

I help you think big, get practical, make plans, set goals, solve problems and make decisions.

I’m your sounding-board, I provide support, I offer guidance and accountability.

Money Coaching designed to improve your financial wellbeing. Bliss. 💆🏾♀️

Who is TLC Money Coaching For?

If you’ve ever felt like this, my service could be right for you:

“I’m educated, I’ve got a good job and people assume I’ve got my sh*t together, especially with money - but I haven’t. And this makes it hard to ask for help. I’m embarrassed, ashamed even, because I think ‘I should have figured this out already, years ago’.”

Perhaps, like the majority of my clients, you recognise that emotional spending is holding you back from where you want to be.

My spending problem is my dirty secret.

You spend money on - as one client put it - stuff I don’t need and sometimes don’t even want. Spending money is a quick fix to make yourself feel better, to comfort and soothe yourself, but the feeling is short-lived. You often feel guilty afterwards and regret the spending. You thought you’d be more financially secure at this point in your life and it scares you that you’re not.

Or perhaps, like some of my clients, it’s the opposite and emotional non-spending / underspending / spending guilt is your issue.

I’m good with money, maybe too good with it.

Because while you spend less than you earn and you’re good with saving, you struggle to spend money on yourself. You convince yourself that you can’t afford it, that you don’t deserve it – whatever ‘it’ is – clothes, a holiday, a home. Then there’s the struggle with making financial decisions. Is now the right time to buy a home? Save or invest? You fear getting it wrong – so you do nothing.

You live with a constant level of stress because money is always nagging at the back of your mind.

You’re now wondering if speaking to someone, a professional, might help.

Someone who can help you understand and take control of your behaviour with money so you can stop stressing about money and start ensuring you have enough to live well - now and in future.

Because while change is scary, staying put is scarier.

If any of this resonates with you, you’ve come to the right place. I’d love to help. 💛

Who is Talia Loderick, Money Coach?

You can read the full story here but the short version is that in 2017 I worked with a coach. And it was an invaluable experience.

Coaching provided me with the professional, emotional, and non-judgemental support I needed to work through my relationship with money.

And it made me think… Coaching! Specialising in money! It’s an actual thing! I wanna do this for a living! And eventually, I did.

In May 2019, I oh-so-quietly launched my business and I’ve had the pleasure of coaching an array of brilliant women ever since.

TLC SIGNATURE

My Signature Money Coaching Package

💛 One-to-one coaching sessions

💛 Six months of support: We’ll meet for two hours, once a month for six months, on Zoom

💛 Email access to me for support and accountability between our monthly coaching sessions

Your investment: £900

Pay in full or pay in six, monthly instalments of £150.

Interested in coaching with me? 📞 Let’s talk.

Click the Book a Call button below and you’ll be taken to my online calendar where you can book your free, 30-minute discovery call. This is an introductory, 'getting to know each other' call. We’ll have a no-obligation, confidential chat about your needs and my service to see if we’re a good fit for each other.